Papua New Guinea

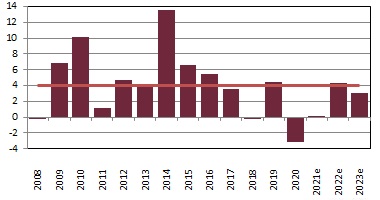

Papua New Guinea has seen tremendous growth in the past few years with Real GDP increasing by 5.8% in 2014 and 5.5% in 2013. Papua New Guinea’s growth is a reflection of the impact of global commodity prices influencing its domestic economy and the influx of foreign investment dollars into large infrastructure projects in the extractive industries. While Papua New Guinea’s economy is expected to grow at a rate of 19.6% through 2015. Growth will be directly tied to commodity prices and its ability to extract resources, which include gold, copper, silver, natural gas, timber, and oil. Agriculture accounts for 32% of GDP and supports 75% of the population. Cash crops include coffee,palm oil, cocoa, copra, tea, rubber, and sugar; 40% of the country is covered with exploitable timber. Papua New Guinea’s looks to invest in its underdeveloped tourism sector in attempts to diversity its economy.

Papua New Guinea - GDP Growth Rate (%)

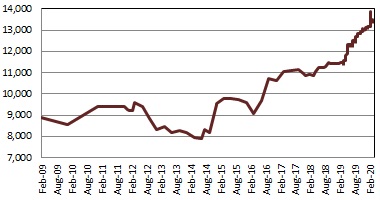

Papua New Guinea - Kina Securities Home Index

Stock Market:

The PNG Exchange Market (PNGX) - (previously Port Moresby Stock Exchange - POMSoX) is the principle stock exchange of Papua New Guinea. The Port Moresby Stock Exchange was incorporated on 26th January 1998 and formally opened its office on 28th April 1999. Trading started on the 4th June 1999 with “Steamships Trading Company Limited” as the only listed company. The launch of the Stock Exchange Steering Committee in 1994 formalized the process to create PNGX after numerous studies and investigations have been undertaken and papers presented by economic commentators, government advisors and organizations, all exploring the viability of a Stock Exchange in the Papua New Guinea economy. PNGX is closely aligned to the Australian Stock Exchange (ASX). The ASX has licensed to PNGX its Business and Listing Rules and PNGX procedures are a mirror image of the ASX.

The PNGX is now fully owned by PNGX Group after it acquired Bank South Pacific’s (BSP) 62.5% majority stake in 2018 and Kina Securities Limited’s stake. There are currently 2 brokers active at PNGX: Kina Securities Limited and JMP Securities Ltd. which acquired BSP Capital in April 2020 from Bank South Pacific.

The PNGX currently lists 11 companies and has a total market capitalization of USD 70.7 billion as of February 2025. However, excluding 5 dual listings, such as Newmont Corporation and Santos, the market cap is USD 2.7 billion as of February 2025 compromising of 7 listed local stocks of which USD 2.4 billion is Bank South Pacific (BSP), one of the leading banks in Papua New Guinea, Cook Islands, Fiji, Samoa, Solomon Islands, Tonga and Vanuatu.

Useful Links:

PNG Exchange Market (PNGX) website: www.pngx.com.pg

Bank South Pacific website: www.bsp.com.pg

PAPUA NEW GUINEA

Population: 8m

5 Year average GDP Growth: 6.4%

- Resource rich: gold, copper, natural gas, oil

- Cash crops: coffee, copra, tea, rubber, sugar

- Port Moresby Stock Exchange has 14 listed stocks

- Tourism underdeveloped