Kazakhstan

Over the past two decades Kazakhstan has transitioned from a lower middle-income to upper middle-income country off the back of a stable political environment and an abundance of natural resources. With a population of 18 million, whose median age is 30 years, Kazakhstan holds 12% of the world’s uranium and ranks 12th in proven oil reserves, in addition to hosting strategic reserves of chrome and cobalt. Kazakhstan is geographically positioned in such a way that it has become the main trans-shipment hub for goods making their way via railroad between China and Europe and it is expected that Kazakhstan will become a significant logistics hub in the future as a direct beneficiary of China’s One Belt One Road initiative.

Kazakhstan experienced a broad economic slowdown in 2015 due to a combination of economic sanctions against Russia and a collapse in oil prices. This led Kazakhstan to unpeg the Kazakh Tenge from the US Dollar. During this difficult period, the government initiated a significant liberalization policy which is expected to see 902 companies privatized by 2020 and an eventual decrease in government participation in the economy from a current 70% to 15%. This privatization program is expected to spark further interest in the Kazakh economy with the government seeking to attract investment in technology and healthcare, part of its goal of transitioning to a knowledge-based economy.

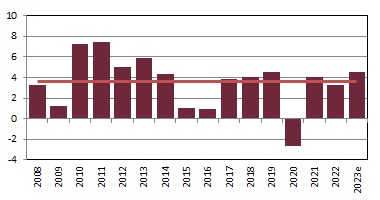

Kazakhstan - GDP Growth Rate (%)

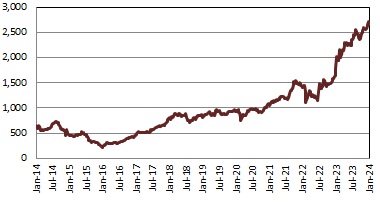

Kazakhstan Stock Exchange Index

Stock Market:

Kazakhstan hosts two stock exchanges. The first is the Kazakhstan Stock Exchange (KASE), established in Almaty on 30th December 1993 under the name “Kazakhstan Inter-Bank Currency Exchange” to support the development of the new national currency, the Kazakh Tenge. On 3rd March 1994 the exchange was re-registered under the name “Kazakhstan Interbank Currency Exchange” and again on 12th July 1995 under the name “Kazakhstan Inter-Bank Currency and Stock Exchange” with the intention to develop the securities market. Shortly thereafter, on 12th April 1996 the exchange was re-registered again under the name “Kazakhstan Stock Exchange”. KASE lists as of February 2025 156 securities: 96 securities from Kazakhstan: 58 securities from 47 issuers as “Premium” or “Standard” category and 38 securities from 34 issuers on the “Alternative Board”. Additionally 60 securities from various companies and countries (mainly U.S.) are traded on “KASE Global” including companies like Airbus, Apple, Coca-Cola, Intel, Microsoft, Nvidia and Tesla).

The country’s second exchange, the Astana International Exchange (AIX) was established on 1st January 2018 as part of the greater Astana International Financial Centre, located in the capital city, Astana. The main purpose of the AIX is to host the IPO’s of state owned enterprises controlled by Kazakhstan’s sovereign wealth fund, Samruk-Kazyna. Trading in equities started on 14th November 2018 with the listing of Kazatomprom. The first foreign company, Polymetal International PLC from Russia, was listed on 25th April 2019. As of February 2025 AIX lists 26 equity securities or GDR’s.

On 7th June 2023, AIX revealed its agreement with the Abu Dhabi Securities Exchange (ADX) to become a member of the Tabadul Hub. With AIX’s inclusion in the Tabadul Hub, the platform’s reach and functionalities will be enhanced, providing Kazakh investors with a smoother and more effective trading environment by accessing the Abu Dhabi stock market. On 17th February 2025 KASE also joined the Tabadul Hub.

Useful Links:

Kazakhstan Stock Exchange (KASE) website: www.kase.kz

Astana International Exchange (AIX) website: www.aix.kz

KAZAKHSTAN

Population: 17.8m

5 Year average GDP growth: 4.1%

- 12 largest oil reserves globally

- Significant endowment of natural resources

- Largest trading partner: Russia

- Strategically located to benefit from China’s BRI