Why Asian Frontier Markets?

Asian frontier markets are a relatively under-researched asset class compared to its larger emerging market peers in the region. At times, Asian frontier markets are misunderstood and also ignored. A combination of these factors has led to very attractive valuations for Asian frontier markets while economic growth remains robust, and the demographics of this region remain extremely attractive. Below are some of the key reasons why investors should consider Asian frontier markets as part of an investment portfolio:

- Robust GDP Growth

- Very favourable demographics which support future consumption

- Asian frontier markets are transforming into low-cost manufacturing hubs

- Asian frontier markets trade at very attractive valuations

- Asian frontier markets offer diversification benefits through low correlations with global markets.

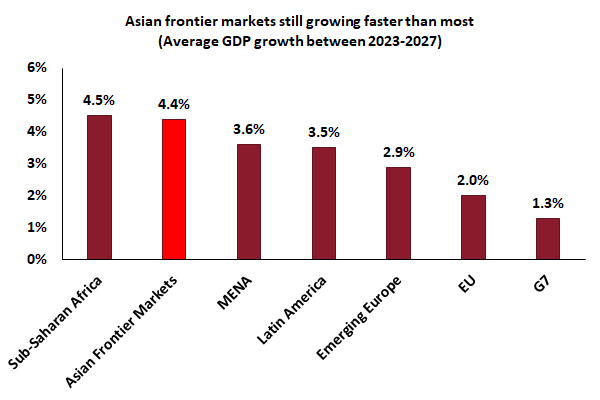

Asian Frontier Markets are Expected to Grow Faster than Other Major Economic Regions

GDP growth rates in Asian frontier markets are significantly higher than in other regions. These superior growth rates are due to higher industrialisation, increasing exports and greater consumption resulting from very favourable demographics. Countries such as Bangladesh, Myanmar, Uzbekistan and Vietnam are expected to post robust GDP growth rates of 6-7% over the next five years, making them amongst the fastest growing globally.

(Source: International Monetary Fund)

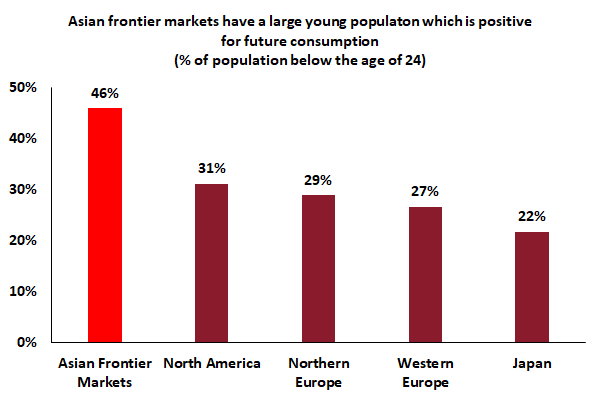

Extremely Favourable Demographics Support Increased Consumption in Asian Frontier Markets

Another attraction of Asian frontier markets is their favourable demographics with a large young population with rising disposable incomes. Countries such as Bangladesh, Pakistan and Vietnam are amongst the most populous globally, and this allows investors to participate in increasing consumption through investments in automobile, consumer staples, healthcare and modern retail companies.

(Source: United Nations Population Division)

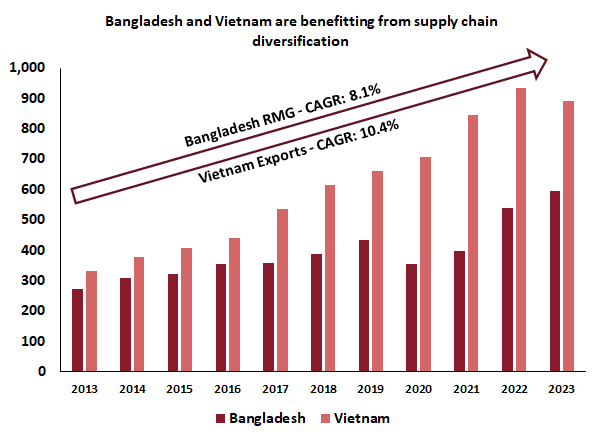

Asian Frontier Markets are Transforming into Manufacturing Hubs

This is one of the most important trends playing out in Asian frontier markets. Higher labour costs in China and other high-cost locations has over the years led to a shift of manufacturing activity into lower-cost destinations like Bangladesh, Cambodia, Myanmar and Vietnam. Bangladesh is now the second-largest garment exporter globally while Vietnam is transforming into a hub for electronics manufacturing with Samsung assembling a majority of its smartphones in Vietnam. Trade tensions have also played out positively for markets such as Bangladesh and Vietnam as they both have witnessed increased orders from the U.S. as well as more factory relocations from China.

*Rebased to 100 (2006). RMG: Ready Made Garments

(Source: Bangladesh Garment Manufacturers & Exporters Association,

General Statistics Office of Vietnam)

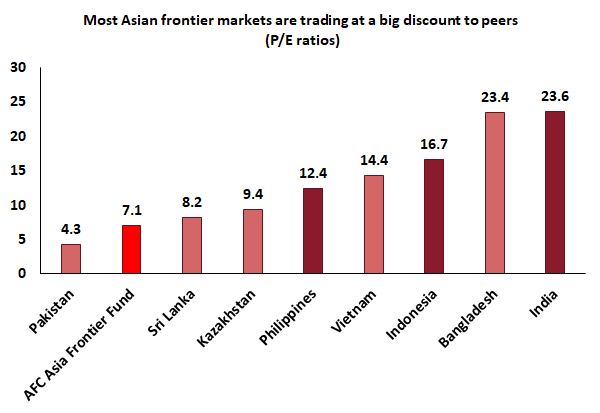

Asian Frontier Markets Trade at Very Attractive Valuations

Since Asian frontier markets are relatively under-researched and at times misunderstood, valuations are not demanding and allow investors to take a longer-term view for a company’s or economy’s growth to play out. As can be seen in the chart below, Asian frontier markets are trading at big discounts to their emerging market peers despite having prospects for sound earnings growth going forward.

(Source: Bloomberg, as of 31st December 2024)

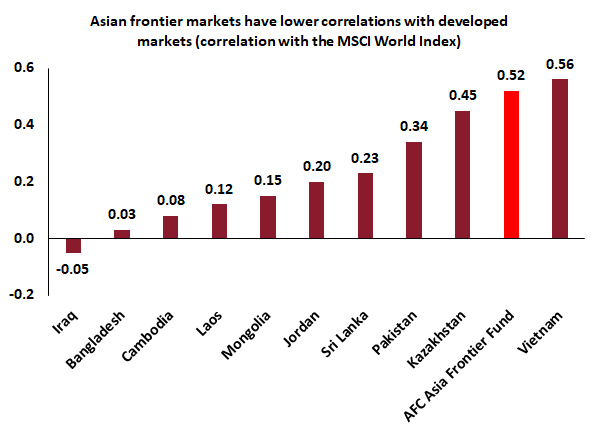

Asian Frontier Markets Offer Low Correlations with Developed Markets – A Sound Diversification Tool

Frontier markets in Asia have historically displayed low correlations with developed markets while some markets such as Bangladesh and Iraq have a very low correlation with the MSCI World Index. This kind of diversification is not available in other equity asset classes and provides much-needed diversification for investors.

(Source: Bloomberg, since inception, based on monthly data, as of 31st December 2024)