Georgia

Over the past decade, Georgia has emerged as an investor-friendly economy strategically located on the Black Sea as a gateway between Asia and Europe. Georgia ranks very highly on many important economic indicators with the country being ranked #7 in the 2020 World Bank Doing Business Report and ranked #12 in the 2019 Fraser Institute Economic Freedom Index. Georgia’s economy is diverse across industries such as agriculture, construction, manufacturing, and trade, while the tourism industry has evolved into a significant driver for the economy as it accounted for 8.1% of GDP in 2019 and brought in USD 3.3 billion of foreign exchange earnings.

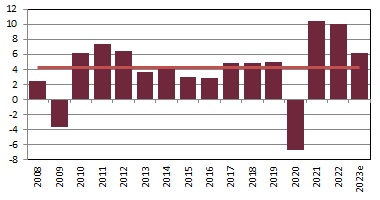

The outlook for economic growth is also bright as the country recovers from the pandemic with the Asian Development Bank (ADB) forecasting GDP growth of 8.5% in 2021 and 6.5% in 2022, the highest economic growth rate within the Central Asian region.

Georgia - GDP Growth Rate (%)

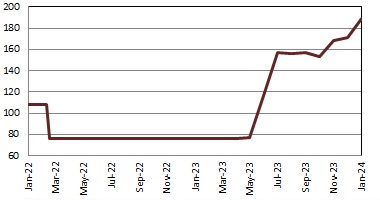

Georgia - GSX General Index

Stock Market:

Equity securities first appeared in Georgia in 1991 after the declaration of independence that signalled the beginning of market-oriented reforms. A vast majority of the newly established joint-stock companies were owned by a rather small number of private shareholders and trading in these shares was relatively inactive. With the launch of the Mass Privatization Program in 1994, approximately 1,300 state-owned enterprises were organized as joint-stock companies, creating about half a million individual private shareholders. However, during a five-year period (1994-1999), the lack of an appropriate legal framework and organized market infrastructure seriously impeded the secondary trading of these shares and any over-the-counter market activity was nearly non-existent.

The Georgian Stock Exchange (GSE) was founded in 1999 by a group of Georgian securities market professionals, leading banks, investment and insurance companies and is the sole securities exchange in Georgia, with its headquarters in Tbilisi. To promote the concept of self-regulation, the GSE membership adopted new rules. After approval of these rules by the National Securities Commission of Georgia, the GSE was officially recognized as a self-regulatory organization (SRO) and received a stock exchange license in January 2000. Official trading at the GSE began in March 2000. The number of companies admitted for trading at the GSE trading system increased gradually and by the end of 2004 reached 277. Practically all of these companies were former state owned and operated companies transformed into joint-stock companies and then privatized.

As of August 2025, there were shares of 4 companies listed on the GSE with a total market capitalization of USD 478 million. However, there are some large and well-established companies from Georgia listed on the London Stock Exchange (LSE). The two largest banks, TBC Bank Group PLC (not listed on the GSE) and Bank of Georgia Group PLC are both listed on the LSE with a market capitalization of more than USD 2.2 billion and USD 2.5 billion respectively. The third company from Georgia listed on the LSE (but not on the GSE) is Georgia Capital which has a market capitalization of USD 584 million (all as of February 2025). 8 brokerage companies are as of August 2025 admitted for trading at the GSE.

Useful Links:

Georgian Stock Exchange (GSE) website: www.gse.ge

GEORGIA

Population: 3.7m

2021 GDP Growth: 10.6%

- Tourism industry is seeing a rebound

- Business friendly environment

- Strategic access to Black Sea ports