Why Asian Frontier Markets?

Asian frontier markets are a relatively under-researched asset class compared to its larger emerging market peers in the region. At times, Asian frontier markets are misunderstood and also ignored. A combination of these factors has led to very attractive valuations for Asian frontier markets while economic growth remains robust, and the demographics of this region remain extremely attractive. Below are some of the key reasons why investors should consider Asian frontier markets as part of an investment portfolio:

- Robust GDP Growth

- Very favourable demographics which support future consumption

- Asian frontier markets are transforming into low-cost manufacturing hubs

- Asian frontier markets trade at very attractive valuations

- Asian frontier markets offer diversification benefits through low correlations with global markets.

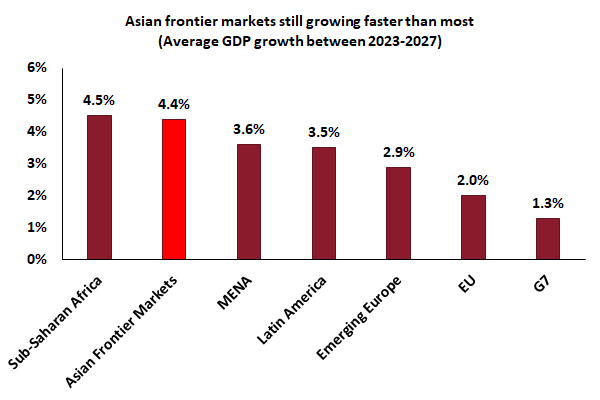

Asian frontier markets are expected to grow faster than other major economic regions

GDP growth rates in Asian frontier markets are significantly higher than in other regions. These superior growth rates are due to higher industrialisation, increasing exports and greater consumption resulting from very favourable demographics. Countries such as Bangladesh, Myanmar, Uzbekistan and Vietnam are expected to post robust GDP growth rates of 6-7% over the next five years, making them amongst the fastest growing globally.

(Source: International Monetary Fund)

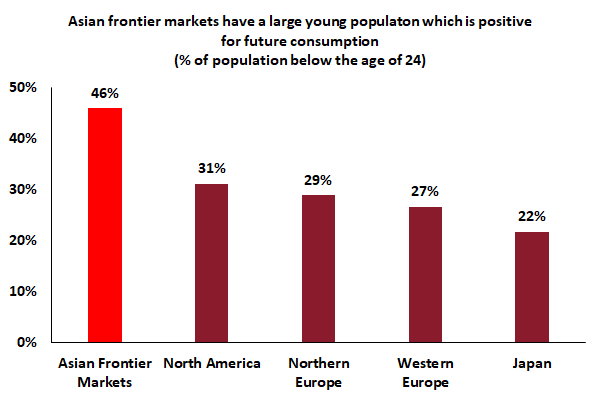

Extremely favourable demographics support increased consumption in Asian frontier markets

Another attraction of Asian frontier markets is their favourable demographics with a large young population with rising disposable incomes. Countries such as Bangladesh, Pakistan and Vietnam are amongst the most populous globally, and this allows investors to participate in increasing consumption through investments in automobile, consumer staples, healthcare and modern retail companies.

(Source: United Nations Population Division)

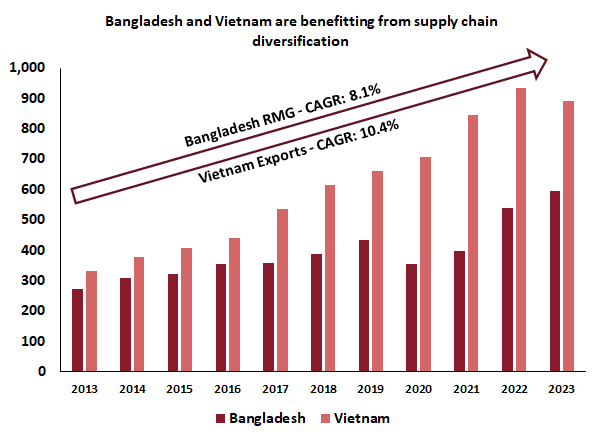

Asian frontier markets are transforming into low-cost manufacturing hubs

This is one of the most important trends playing out in Asian frontier markets. Higher labour costs in China and other high-cost locations has over the years led to a shift of manufacturing activity into lower-cost destinations like Bangladesh, Cambodia, Myanmar and Vietnam. Bangladesh is now the second-largest garment exporter globally while Vietnam is transforming into a hub for electronics manufacturing with Samsung assembling a majority of its smartphones in Vietnam. Trade tensions have also played out positively for markets such as Bangladesh and Vietnam as they both have witnessed increased orders from the U.S. as well as more factory relocations from China.

*Rebased to 100 (2006). RMG: Ready Made Garments

(Source: Bangladesh Garment Manufacturers & Exporters Association,

General Statistics Office of Vietnam)

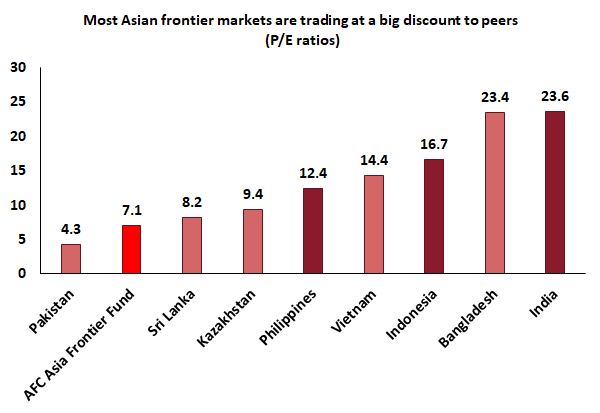

Asian frontier markets trade at very attractive valuations

Since Asian frontier markets are relatively under-researched and at times misunderstood, valuations are not demanding and allow investors to take a longer-term view for a company’s or economy’s growth to play out. As can be seen in the chart below, Asian frontier markets are trading at big discounts to their emerging market peers despite having prospects for sound earnings growth going forward.

(Source: Bloomberg, as of 31st March 2024)

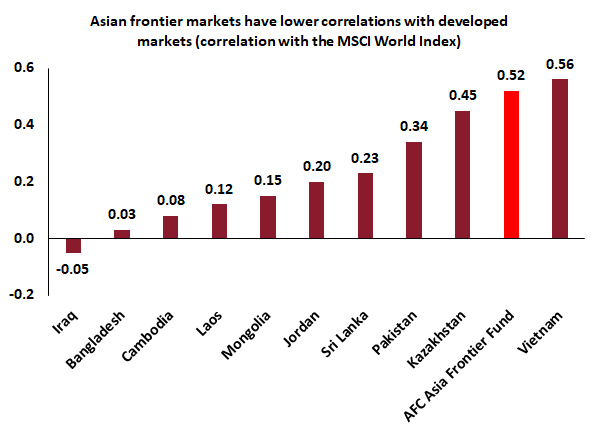

Asian frontier markets offer low correlations with developed markets – a sound diversification tool

Frontier markets in Asia have historically displayed low correlations with developed markets while some markets such as Bangladesh and Iraq have a very low correlation with the MSCI World Index. This kind of diversification is not available in other equity asset classes and provides much-needed diversification for investors.

(Source: Bloomberg, since inception, based on monthly data, as of 31st March 2024)

For further information on our funds, click one of the links below:

Asia Frontier Capital Email Preference Settings

Please use the form below to update your subscription details. You can also unsubscribe from our newsletter by clicking the “Unsubscribe” link at the bottom of the form.

Unsubscription Successful

Your email address has been removed from our newsletter mailing list,

in the future you will not receive our newsletter.

Newsletter Unsubscribe

Dear reader of the Asia Frontier Capital newsletter. We are sorry to see you unsubscribe from our newsletter. By unsubscribing you will no longer receive Asia Frontier Capital's monthly updates or ad-hoc messages about developments. Please leave a short comment to let us know why you are unsubscribing or how we could improve our newsletter.

Terms of Use

It is important that you read the contents of this notice carefully before accessing the www.asiafrontiercapital.com website. This notice governs your access to and use of the website. By accessing the website you agree to accept the terms of this notice and the following terms of use. If you do not agree to abide by these, you must stop using this website immediately.

The information contained in this section is provided for reference only and does not constitute a distribution, an offer to sell or a solicitation of an offer to buy any securities.

This web site is for information purposes only and does not constitute an offer to sell or a solicitation to buy. Past performance is not indicative of future results. No assurance can be given that the investment objective will be achieved or that an investor will receive a return of all or part of his/her initial capital and investment results can fluctuate substantially over any given time period. Any questions should be directed to an approved Asia Frontier Capital Limited and/or Asia Frontier Investments Limited and or AFC Umbrella Fund and/or AFC Umbrella Fund (non-US) representative.

Each country has different securities laws and it is up to the individual to determine if they will be in compliance with their country's laws in dealing with Asia Frontier Capital Limited add/or Asia Frontier Investments Limited and or AFC Umbrella Fund and/or AFC Umbrella Fund (non-US). By going further into this site, you signify that you will be in compliance with your country's regulations and that Asia Frontier Capital Limited and/or Asia Frontier Investments Limited are not liable for any misrepresentation.

This website and all information provided on it:

- is solely intended for your private use;

- is not for distribution to, or use by, any person or entity in any jurisdiction where such distribution or use would be contrary to any law or regulation or which would subject Asia Frontier Investments Limited and/or Asia Frontier Capital Limited and or AFC Umbrella Fund and/or AFC Umbrella Fund (non-US) to any regulatory requirements in such jurisdiction;

- is not directed at persons, and is not to be regarded as an offer to buy or sell or an invitation to buy or sell investments, securities or to accept deposits or to provide any other products or services in any jurisdiction, to any person to whom it is unlawful to make such an offer or solicitation;

- does not constitute investment advice on the merits or suitability of any investment product and no information contained within the website should be construed as such.

- is published as a service for reference purposes only and not to solicit any action based upon it.

- may be changed or amended without prior notice.

The information on the website must not be relied on for purposes of any investment decisions. Investors should rely only on the fund's offering documents when making any decision to invest. Before making any decision to invest, we recommend that all relevant documents, such as reports, key investor information document and accounts and prospectus should be read, which specify the particular risks associated with investment in the Company, together with any specific restrictions applying and the basis of dealing. The contents of this website should not be construed as legal, taxation or financial advice. If in doubt you should speak to your professional adviser

Investors should note investment involves risk. The price of units may go down as well as up and you may not receive back the amount originally invested. Past performance is not indicative of future results. Changes in exchange rates may have an adverse effect on the value, price, or income of any investment. There are additional risks associated with investing in frontier, emerging and developing markets. There is no assurance or guarantee that the investment objective can be achieved and investment results may vary substantially over time.

Asia Frontier Capital Limited and/or Asia Frontier Investments Limited and or AFC Umbrella Fund and/or AFC Umbrella Fund (non-US) do not make representation that information and materials on this site are appropriate for use in all jurisdictions available on the web, or that transactions, securities, products, instruments or services offered on this site are available or indeed appropriate for sale or use in all jurisdictions, or by all investors or other potential clients. Those who access this site do so on their own initiative, and are therefore responsible for compliance with applicable local laws and regulations. By accessing each site, the entrant has agreed that he/she has reviewed the site in its entirety including any legal or regulatory rubric.

To the best of its knowledge and belief, Asia Frontier Capital Limited and/or Asia Frontier Investments Limited and or AFC Umbrella Fund and/or AFC Umbrella Fund (non-US) consider the information contained herein is accurate as at the date of publication. Under no circumstances should this information or any part of it be copied, reproduced or redistributed.

By proceeding to access information contained herein, users are deemed to be representing and warranting that they are either Hong Kong Professional Investor or are observing the applicable laws and regulations of their relevant jurisdictions.

Under Cap 571 of the Hong Kong "Securities & Futures Ordinance" Schedule 1:

- "Professional investor" means:

- any recognized exchange company, recognized clearing house, recognized exchange controller or recognized investor compensation company, or any person authorized to provide automated trading services under section 95(2) of this Ordinance;

- any intermediary, or any other person carrying on the business of the provision of investment services and regulated under the law of any place outside Hong Kong;

- any authorized financial institution, or any bank which is not an authorized financial institution but is regulated under the law of any place outside Hong Kong;

- any insurer authorized under the Insurance Companies Ordinance (Cap 41), or any other person carrying on insurance business and regulated under the law of any place outside Hong Kong;

- any scheme which-

- is a collective investment scheme authorized under section 104 of this Ordinance; or

- is similarly constituted under the law of any place outside Hong Kong and, if it is regulated under the law of such place, is permitted to be operated under the law of such place, or any person by whom any such scheme is operated;

- any registered scheme as defined in section 2(1) of the Mandatory Provident Fund Schemes Ordinance (Cap 485), or its constituent fund as defined in section 2 of the Mandatory Provident Fund Schemes (General) Regulation (Cap 485 sub. leg. A), or any person who, in relation to any such registered scheme, is an approved trustee or service provider as defined in section 2(1) of that Ordinance or who is an investment manager of any such registered scheme or constituent fund;

- any scheme which-

- is a registered scheme as defined in section 2(1) of the Occupational Retirement Schemes Ordinance (Cap 426); or

- is an offshore scheme as defined in section 2(1) of that Ordinance and, if it is regulated under the law of the place in which it is domiciled, is permitted to be operated under the law of such place, or any person who, in relation to any such scheme, is an administrator as defined in section 2(1) of that Ordinance;

- any government (other than a municipal government authority), any institution which performs the functions of a central bank, or any multilateral agency;

- except for the purposes of Schedule 5 to this Ordinance, any corporation which is-

- a wholly owned subsidiary of –

- an intermediary, or any other person carrying on the business of the provision of investment services and regulated under the law of any place outside Hong Kong; or

- an authorized financial institution, or any bank which is not an authorized financial institution but is regulated under the law of any place outside Hong Kong;

- a holding company which holds all the issued share capital of-

- 1. an intermediary, or any other person carrying on the business of the provision of investment services and regulated under the law of any place outside Hong Kong; or

- 2. an authorized financial institution, or any bank which is not an authorized financial institution but is regulated under the law of any place outside Hong Kong; or

- any other wholly owned subsidiary of a holding company referred to in subparagraph (ii); or

- a wholly owned subsidiary of –

any person of a class which is prescribed by rules made under section 397 of this Ordinance for the purposes of this paragraph as within the meaning of this definition for the purposes of the provisions of this Ordinance, or to the extent that it is prescribed by rules so made as within the meaning of this definition for the purposes of any provision of this Ordinance.

This website has not been reviewed by the Securities and Futures Commission "SFC" in Hong Kong.