AFC Vietnam Fund Blog

AFC Vietnam Fund Market Updates - English

- AFC Vietnam Fund Monthly Update English - 30th June 2024

- AFC Vietnam Fund Monthly Update English - 31st May 2024

- AFC Vietnam Fund Monthly Update English - 30th April 2024

- AFC Vietnam Fund Monthly Update English - 31st March 2024

- AFC Vietnam Fund Monthly Update English - 29th February 2024

- AFC Vietnam Fund Monthly Update English - 31st January 2024

- AFC Vietnam Fund Monthly Update English - 31st December 2023

- AFC Vietnam Fund Monthly Update English - 30th November 2023

- AFC Vietnam Fund Monthly Update English - 31st October 2023

- AFC Vietnam Fund Monthly Update English - 30th September 2023

- AFC Vietnam Fund Monthly Update English - 31st August 2023

- AFC Vietnam Fund Monthly Update English - 31st July 2023

- AFC Vietnam Fund Monthly Update English - 30th June 2023

- AFC Vietnam Fund Monthly Update English - 31st May 2023

- AFC Vietnam Fund Monthly Update English - 30th April 2023

- AFC Vietnam Fund Monthly Update English - 31st March 2023

- AFC Vietnam Fund Monthly Update English - 28th February 2023

- AFC Vietnam Fund Monthly Update English - 31st January 2023

- AFC Vietnam Fund Monthly Update English - 31st December 2022

- AFC Vietnam Fund Monthly Update English - 30th November 2022

- AFC Vietnam Fund Monthly Update English - 31st October 2022

- AFC Vietnam Fund Monthly Update English - 30th September 2022

- AFC Vietnam Fund Monthly Update English - 31st August 2022

- AFC Vietnam Fund Monthly Update English - 31st July 2022

- AFC Vietnam Fund Monthly Update English - 30th June 2022

- AFC Vietnam Fund Monthly Update English - 31st May 2022

- AFC Vietnam Fund Monthly Update English - 30th April 2022

- AFC Vietnam Fund Monthly Update English - 31st March 2022

- AFC Vietnam Fund Monthly Update English - 28th February 2022

- AFC Vietnam Fund Monthly Update English - 31st January 2022

- AFC Vietnam Fund Monthly Update English - 31st December 2021

- AFC Vietnam Fund Monthly Update English - 30th November 2021

- AFC Vietnam Fund Monthly Update English - 31st October 2021

- AFC Vietnam Fund Monthly Update English - 30th September 2021

- AFC Vietnam Fund Monthly Update English - 31st August 2021

- AFC Vietnam Fund Monthly Update English - 31st July 2021

- AFC Vietnam Fund Monthly Update English - 30th June 2021

- AFC Vietnam Fund Monthly Update English - 31st May 2021

- AFC Vietnam Fund Monthly Update English - 30th April 2021

- AFC Vietnam Fund Monthly Update English - 31st March 2021

- AFC Vietnam Fund Monthly Update English - 28th February 2021

- AFC Vietnam Fund Monthly Update English - 31st January 2021

- AFC Vietnam Fund Monthly Update English - 31st December 2020

- AFC Vietnam Fund Monthly Update English - 30th November 2020

- AFC Vietnam Fund Monthly Update English - 31st October 2020

- AFC Vietnam Fund Monthly Update English - 30th September 2020

- AFC Vietnam Fund Monthly Update English - 31st August 2020

- AFC Vietnam Fund Monthly Update English - 31st July 2020

- AFC Vietnam Fund Monthly Update English - 30th June 2020

- AFC Vietnam Fund Monthly Update English - 31st May 2020

- AFC Vietnam Fund Monthly Update English - 30th April 2020

- AFC Vietnam Fund Monthly Update English - 31st March 2020

- AFC Vietnam Fund Monthly Update English - 29th February 2020

- AFC Vietnam Fund Monthly Update English - 31st January 2020

- AFC Vietnam Fund Monthly Update English - 31st December 2019

- AFC Vietnam Fund Interim Update English - 15th December 2019

- AFC Vietnam Fund Monthly Update English - 30th November 2019

- AFC Vietnam Fund Interim Update English - 15th November 2019

- AFC Vietnam Fund Monthly Update English - 31st October 2019

- AFC Vietnam Fund Interim Update English - 15th October 2019

- AFC Vietnam Fund Monthly Update English - 30th September 2019

- AFC Vietnam Fund Interim Update English - 15th September 2019

- AFC Vietnam Fund Monthly Update English - 31st August 2019

- AFC Vietnam Fund Interim Update English - 15th August 2019

- AFC Vietnam Fund Monthly Update English - 31st July 2019

- AFC Vietnam Fund Interim Update English - 15th July 2019

- AFC Vietnam Fund Monthly Update English - 30th June 2019

- AFC Vietnam Fund Interim Update English - 15th June 2019

- AFC Vietnam Fund Monthly Update English - 31st May 2019

- AFC Vietnam Fund Interim Update English - 15th May 2019

- AFC Vietnam Fund Monthly Update English - 30th April 2019

- AFC Vietnam Fund Interim Update English - 15th April 2019

- AFC Vietnam Fund Monthly Update English - 31st March 2019

- AFC Vietnam Fund Interim Update English - 15th March 2019

- AFC Vietnam Fund Monthly Update English - 28th February 2019

- AFC Vietnam Fund Interim Update English - 15th February 2019

- AFC Vietnam Fund Monthly Update English - 31st January 2019

- AFC Vietnam Fund Interim Update English - 15th January 2019

- AFC Vietnam Fund Monthly Update English - 31st December 2018

- AFC Vietnam Fund Interim Update English - 15th December 2018

- AFC Vietnam Fund Monthly Update English - 30th November 2018

- AFC Vietnam Fund Interim Update English - 15th November 2018

- AFC Vietnam Fund Monthly Update English - 31st October 2018

- AFC Vietnam Fund Interim Update English - 15th October 2018

- AFC Vietnam Fund Monthly Update English - 30th September 2018

- AFC Vietnam Fund Interim Update English - 15th September 2018

- AFC Vietnam Fund Monthly Update English - 31st August 2018

- AFC Vietnam Fund Interim Update English - 15th August 2018

- AFC Vietnam Fund Monthly Update English - 31st July 2018

- AFC Vietnam Fund Interim Update English - 15th July 2018

- AFC Vietnam Fund Monthly Update English - 30th June 2018

- AFC Vietnam Fund Interim Update English - 15th June 2018

- AFC Vietnam Fund Monthly Update English - 31st May 2018

- AFC Vietnam Fund Interim Update English - 15th May 2018

- AFC Vietnam Fund Monthly Update English - 30th April 2018

- AFC Vietnam Fund Interim Update English - 15th April 2018

- AFC Vietnam Fund Monthly Update English - 31st March 2018

- AFC Vietnam Fund Interim Update English - 15th March 2018

- AFC Vietnam Fund Monthly Update English - 28th February 2018

- AFC Vietnam Fund Interim Update English - 15th January 2018

- AFC Vietnam Fund Monthly Update English - 31st December 2017

- AFC Vietnam Fund Interim Update English - 15th December 2017

- AFC Vietnam Fund Monthly Update English - 30th November 2017

- AFC Vietnam Fund Interim Update English - 15th November2017

- AFC Vietnam Fund Monthly Update English - 31st October 2017

- AFC Vietnam Fund Interim Update English - 15th October2017

- AFC Vietnam Fund Monthly Update English - 30th September 2017

- AFC Vietnam Fund Interim Update English - 15th September 2017

- AFC Vietnam Fund Monthly Update English - 31st August 2017

- AFC Vietnam Fund Interim Update English - 15th August 2017

- AFC Vietnam Fund Monthly Update English - 31st July 2017

- AFC Vietnam Fund Interim Update English - 15th July 2017

- AFC Vietnam Fund Monthly Update English - 30th June 2017

- AFC Vietnam Fund Interim Update English - 15th June 2017

- AFC Vietnam Fund Monthly Update English - 31st May 2017

- AFC Vietnam Fund Interim Update English - 15th May 2017

- AFC Vietnam Fund Monthly Update English - 30th April 2017

- AFC Vietnam Fund Interim Update English - 15th April 2017

- AFC Vietnam Fund Monthly Update English - 31st March 2017

- AFC Vietnam Fund Interim Update English - 15th March 2017

- AFC Vietnam Fund Monthly Update English - 28th February 2017

- AFC Vietnam Fund Interim Update English - 14th February 2017

- AFC Vietnam Fund Monthly Update English - 31st January 2017

- AFC Vietnam Fund Interim Update English - 13th January 2017

- AFC Vietnam Fund Monthly Update English - 31st December 2016

- AFC Vietnam Fund Interim Update English - 14th December 2016

- AFC Vietnam Fund Monthly Update English - 30th November 2016

- AFC Vietnam Fund Interim Update English - 13th November 2016

- AFC Vietnam Fund Monthly Update English - 31st October 2016

- AFC Vietnam Fund Interim Update English - 15th October 2016

- AFC Vietnam Fund Monthly Update English - 30th September 2016

- AFC Vietnam Fund Interim Update English - 15th September 2016

- AFC Vietnam Fund Monthly Update English - 31st August 2016

- AFC Vietnam Fund Interim Update English - 15th August 2016

- AFC Vietnam Fund Monthly Update English - 31st July 2016

- AFC Vietnam Fund Interim Update English - 15th July 2016

- AFC Vietnam Fund Monthly Update English - 30th June 2016

- AFC Vietnam Fund Interim Update English - 15th June 2016

- AFC Vietnam Fund Monthly Update English - 31st May 2016

- AFC Vietnam Fund Interim Update English - 15th May 2016

- AFC Vietnam Fund Monthly Update English - 30th April 2016

- AFC Vietnam Fund Interim Update English - 15th April 2016

- AFC Vietnam Fund Monthly Update English - 31st March 2016

- AFC Vietnam Fund Interim Update English - 12th March 2016

- AFC Vietnam Fund Monthly Update English - 29th February 2016

- AFC Vietnam Fund Interim Update English - 05th February 2016

- AFC Vietnam Fund Monthly Update English - 31st January 2016

- AFC Vietnam Fund Interim Update English - 15th January 2016

- AFC Vietnam Fund Monthly Update English - 31st December 2015

- AFC Vietnam Fund Interim Update English - 15th December 2015

- AFC Vietnam Fund Monthly Update English - 30th November 2015

- AFC Vietnam Fund Interim Update English - 15th November 2015

- AFC Vietnam Fund Monthly Update English - 31st October 2015

- AFC Vietnam Fund Interim Update English - 18th October 2015

- AFC Vietnam Fund Monthly Update English - 30th September 2015

- AFC Vietnam Fund Interim Update English - 18th September 2015

- AFC Vietnam Fund Monthly Update English - 31st August 2015

- AFC Vietnam Fund Interim Update English - 16th August 2015

- AFC Vietnam Fund Monthly Update English - 31st July 2015

- AFC Vietnam Fund Interim Update English - 17th July 2015

- AFC Vietnam Fund Monthly Update English - 30th June 2015

- AFC Vietnam Fund Interim Update English - 15th June 2015

- AFC Vietnam Fund Monthly Update English - 31st May 2015

- AFC Vietnam Fund Interim Update English - 15th May 2015

- AFC Vietnam Fund Monthly Update English - 30th April 2015

- AFC Vietnam Fund Interim Update English - 15th April 2015

- AFC Vietnam Fund Monthly Update English - 31st March 2015

- AFC Vietnam Fund Interim Update English - 18th March 2015

- AFC Vietnam Fund Monthly Update English - 28th February 2015

- AFC Vietnam Fund Monthly Update English - 31st January 2015

- AFC Vietnam Fund Interim Update English - 15th January 2015

- AFC Vietnam Fund Monthly Update English - 31st December 2014

- AFC Vietnam Fund Interim Update English - 15th December 2014

- AFC Vietnam Fund Monthly Update English - 30th November 2014

- AFC Vietnam Fund Interim Update English - 16th November 2014

- AFC Vietnam Fund Monthly Update English - 31st October 2014

- AFC Vietnam Fund Interim Update English - 15th October 2014

- AFC Vietnam Fund Monthly Update English - 30th September 2014

- AFC Vietnam Fund Interim Update English - 14th September 2014

- AFC Vietnam Fund Monthly Update English - 30th August 2014

- AFC Vietnam Fund Interim Update English - 15th August 2014

- AFC Vietnam Fund Monthly Update English - 31st July 2014

- AFC Vietnam Fund Monthly Update English - 30th June 2014

AFC Vietnam Fund Market Updates - German

- AFC Vietnam Fund Interim Update German - 15th September 2016

- AFC Vietnam Fund Monthly Update German - 31st August 2016

- AFC Vietnam Fund Interim Update German - 15th August 2016

- AFC Vietnam Fund Monthly Update German - 31st July 2016

- AFC Vietnam Fund Interim Update German - 15th July 2016

- AFC Vietnam Fund Monthly Update German - 30th June 2016

- AFC Vietnam Fund Interim Update German - 15th June 2016

- AFC Vietnam Fund Monthly Update German - 31st May 2016

- AFC Vietnam Fund Interim Update German - 15th May 2016

- AFC Vietnam Fund Monthly Update German - 30th April 2016

- AFC Vietnam Fund Interim Update German - 15th April 2016

- AFC Vietnam Fund Monthly Update German - 31st March 2016

- AFC Vietnam Fund Interim Update German - 12th March 2016

- AFC Vietnam Fund Monthly Update German - 29th February 2016

- AFC Vietnam Fund Interim Update German - 05th February 2016

- AFC Vietnam Fund Monthly Update German - 31st January 2016

- AFC Vietnam Fund Interim Update German - 15th January 2016

- AFC Vietnam Fund Monthly Update German - 31st December 2015

- AFC Vietnam Fund Interim Update German - 15th December 2015

- AFC Vietnam Fund Monthly Update German - 30th November 2015

- AFC Vietnam Fund Interim Update German - 15th November 2015

- AFC Vietnam Fund Monthly Update German - 31st October 2015

- AFC Vietnam Fund Interim Update German - 18th October 2015

- AFC Vietnam Fund Monthly Update German - 30th September 2015

- AFC Vietnam Fund Interim Update German - 18th September 2015

- AFC Vietnam Fund Monthly Update German - 31st August 2015

- AFC Vietnam Fund Interim Update German - 16th August 2015

- AFC Vietnam Fund Monthly Update German - 31st July 2015

- AFC Vietnam Fund Interim Update German - 17th July 2015

- AFC Vietnam Fund Monthly Update German - 30th June 2015

- AFC Vietnam Fund Interim Update German - 15th June 2015

- AFC Vietnam Fund Monthly Update German - 31st May 2015

- AFC Vietnam Fund Interim Update German - 15th May 2015

- AFC Vietnam Fund Monthly Update German - 30th April 2015

- AFC Vietnam Fund Interim Update German - 15th April 2015

- AFC Vietnam Fund Monthly Update German - 31st March 2015

- AFC Vietnam Fund Interim Update German - 18th March 2015

- AFC Vietnam Fund Monthly Update German - 28th February 2015

- AFC Vietnam Fund Monthly Update German - 31st January 2015

- AFC Vietnam Fund Interim Update German - 15th January 2015

- AFC Vietnam Fund Monthly Update German - 31st December 2014

- AFC Vietnam Fund Interim Update German - 15th December 2014

- AFC Vietnam Fund Monthly Update German - 30th November 2014

- AFC Vietnam Fund Interim Update German - 16th November 2014

- AFC Vietnam Fund Monthly Update German - 31st October 2014

- AFC Vietnam Fund Interim Update German - 15th October 2014

- AFC Vietnam Fund Monthly Update German - 30th September 2014

- AFC Vietnam Fund Interim Update German - 14th September 2014

- AFC Vietnam Fund Monthly Update German - 30th August 2014

- AFC Vietnam Fund Interim Update German - 15th August 2014

- AFC Vietnam Fund Monthly Update German - 31st July 2014

- AFC Vietnam Fund Monthly Update German - 30th June 2014

* The representative of the AFC Vietnam Fund in Switzerland is ACOLIN Fund Services AG, succursale Geneve, 6 Cours de Rive, 1204 Geneva. The distribution of Shares in Switzerland must exclusively be made to qualified investors. The place of performance and jurisdiction for Shares in the Fund distributed in Switzerland are at the registered office of the representative.

** The AFC Vietnam Fund is registered for sale to investors in Japan, Switzerland (qualified investors), Hong Kong & UK (professional investors) and Singapore (accredited investors).

*** By accessing information contained herein, users are deemed to be representing and warranting that they are either a Hong Kong Professional Investor or are observing the applicable laws and regulations of their relevant jurisdictions.

{disclaimer}

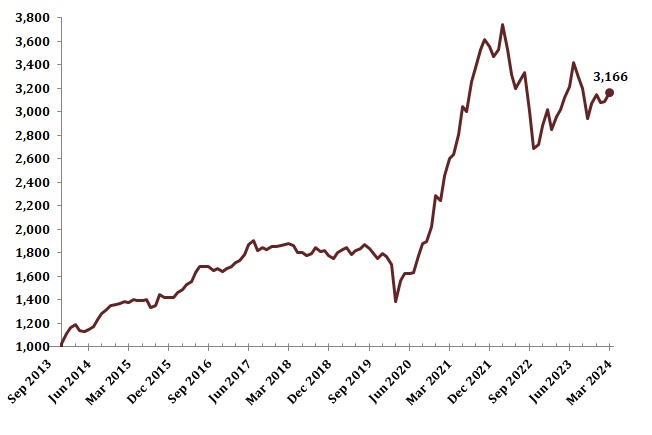

AFC Vietnam Fund Performance

Net Fund Performance - USD - Net

AFC Vietnam Fund

| NAV | 3,272.23 |

|---|---|

| Since Inception | +227.22% |

| Inception Date | 23/12/2013 |

| USD | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | YTD |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2013 | +2.37% | +2.37% | |||||||||||

| 2014 | +8.75% | +4.50% | +2.18% | -4.65% | -0.32% | +1.45% | +1.86% | +5.49% | +3.87% | +2.83% | +2.50% | +0.60% | +32.50% |

| 2015 | +0.44% | +1.76% | -0.96% | +1.93% | -0.48% | +0.06% | +0.22% | -4.57% | +1.18% | +6.90% | -1.82% | +0.25% | +4.62% |

| 2016 | -0.10% | +3.30% | +1.28% | +3.17% | +1.40% | +4.97% | +3.00% | +0.13% | +0.11% | -1.83% | +0.88% | -1.76% | +15.29% |

| 2017 | +1.90% | +1.10% | +1.94% | +1.03% | +2.96% | +4.52% | +1.94% | -4.38% | +1.09% | -0.75% | +1.47% | +0.01% | +13.33% |

| 2018 | +0.41% | +0.42% | +0.58% | -0.93% | -3.24% | -0.12% | -1.28% | +0.79% | +3.02% | -2.15% | +0.45% | -2.05% | -4.17% |

| 2019 | -1.63% | +2.90% | +1.58% | +0.82% | -3.35% | +1.98% | +1.18% | +1.63% | -1.89% | -2.34% | -2.22% | +2.31% | +0.70% |

| 2020 | -1.41% | -3.93% | -18.44% | +12.72% | +4.28% | -0.28% | +0.78% | +8.65% | +6.02% | +0.73% | +6.91% | +12.77% | +27.66% |

| 2021 | -1.89% | +9.49% | +5.84% | +1.58% | +6.37% | +8.37% | -1.30% | +8.47% | +3.80% | +4.47% | +2.42% | -1.69% | +55.61% |

| 2022 | -2.51% | +1.92% | +5.99% | -5.82% | -5.86% | -3.73% | +2.50% | +1.76% | -10.01% | -10.53% | +1.35% | +6.09% | -18.84% |

| 2023 | +4.70% | -5.71% | +3.80% | +2.17% | +3.42% | +3.01% | +6.09% | -3.53% | -2.91% | -8.13% | +4.58% | +2.38% | +9.02% |

| 2024 | -2.24% | +0.49% | +2.47% | -3.72% | +7.35% | +4.05% |

| ISIN | KYG0133A1673 |

|---|---|

| CUSIP | G01333A167 |

| Bloomberg | AFCVIET KY |

| Valoren | 23095153 |

| Risk Classification for Hong Kong Investors | High Risk |

* By accessing information contained herein, users are deemed to be representing and warranting that they are either a Hong Kong Professional Investor or are observing the applicable laws and regulations of their relevant jurisdictions.

** The AFC Vietnam Fund is registered for sale to investors in Japan, Switzerland (qualified investors), Hong Kong & UK (professional investors) and Singapore (accredited investors).

*** For Switzerland only: This is an advertising document. The state of the origin of the fund is the Cayman Islands. This document may only be provided to qualified investors within the meaning of art. 10 para. 3 and 3ter CISA. In Switzerland, the representative is Acolin Fund Services AG, Leutschenbachstrasse 50, 8050 Zurich, Switzerland, whilst the paying agent is NPB Neue Privat Bank AG, Limmatquai 1 / am Bellevue, 8024 Zurich, Switzerland. The basic documents of the fund report may be obtained free of charge from the representative. Past performance is no indication of current or future performance. The performance data do not take account of the commissions, if any, and fund transfer costs incurred on the issue and redemption of units.

{disclaimer}

About AFC Vietnam Fund

AFC Vietnam Fund is managed by Asia Frontier Capital (Vietnam) Limited. The fund aims to achieve long-term capital appreciation for investors by capturing value in undervalued listed Vietnamese equities with a focus on small to medium size companies.

The Cayman Islands domiciled fund is managed under the executive leadership team of Thomas Hugger and Andreas Vogelsanger. This team has more than 50 years of investment experience as well as extensive experience working in Asia, having held senior positions in Cambodia, Hong Kong, Singapore, Sri Lanka, and Thailand.

For more information on the fund's performance or to receive our latest fund factsheet and investor presentation please contact This email address is being protected from spambots. You need JavaScript enabled to view it..

Alternatively, you can find further details using the links on the left.

AFC Vietnam Fund Investment Strategy

The AFC Vietnam Fund is designed to offer investors high returns from growth in equity markets in Vietnam whilst offering a portfolio that has low correlation with global equity markets. The fund aims to achieve long-term capital appreciation for investors by capturing value in in undervalued listed Vietnamese equities over the next 5-7 years, predominantly targeting the small to medium size company segment.

Vietnam has very compelling growth prospects with an attractively valued market that has significant room to grow. Competitive labour costs combined with improvements in human capital as well as economic and trade environments present a strong case for market development. Vietnam has had a stable currency and increasing foreign reserves over the past two years and high GDP growth rates are being supported by fiscal and monetary policy.

Vietnam's markets have seen several years of consolidation since dropping from their highs in 2007 and improving fundamentals will support domestic markets in the next economic cycle. Reaching previous highs in coming stock market cycles would mean a potential increase of several hundred percent in local terms.

For more information on AFC Vietnam Fund please login to review our latest fund factsheet and investor presentation or be in touch with any questions at This email address is being protected from spambots. You need JavaScript enabled to view it..

AFC Vietnam Blog

Welcome to Asia Frontier Capital

AFC Vietnam Fund - News and Updates