AFC Iraq Fund Investment Strategy

The AFC Iraq Fund offers investors the opportunity to capture Iraq's post-conflict recovery potential and the return of stability in its territory. The fund aims to achieve long-term capital appreciation for investors by capturing value in growth companies over the next 7-10 years, predominantly targeting companies leveraged to Iraq’s post-conflict recovery and growth trajectory. Iraq has a low correlation with global, emerging & frontier markets, and thus provides a significant diversification opportunity to investors. The fund's investable universe consists of locally listed companies with their principal business activities in Iraq and foreign-listed companies with the majority of the business in Iraq, including the Kurdistan Region of Iraq (KRI).

The essence of the AFC Iraq investment thesis is arbitraging the delta between the real Iraq risk, high as it is, versus the perceived risk, which is much higher still. This delta is a function of an asymmetric information flow on Iraq that is bound to narrow as this information flow begins to reflect the country’s real developments. The risk-award proposition of the AFC Iraq Fund argues that as this delta narrows, asset prices – priced at the perceived risk – should rise, reflecting the real risk.

Iraq offers a compelling growth story as a country endowed with significant natural resources – holding the world’s fifth largest proved oil reserves and twelfth largest proved natural gas resources – with a large young population of 45.5 million (2023e), with over 65% of the population under the age of 30. The country’s potential was held back, and much of its infrastructure was destroyed by over four decades of conflict, starting with the Iraq-Iran War (1980-1988), the first Gulf War (1990-1991), the extreme and devastating 13 years of UN economic sanctions (1990-2003), the second Gulf War, and the US invasion (2003), which was followed by over a decade of civil strife marked by an anti-occupation insurgency, and civil war, that eventually led to ISIS occupying a third of the country in 2014, which culminated in three-years of savage conflict that ended with the end of ISIS in 2018. The timing of the AFC Iraq Fund launch in 2015 was premised on the thesis that the country stood to benefit from post-conflict recovery as stability offers individuals and businesses the opportunity to work, employ and spend, which would drive domestic consumption and investment. Equity markets in post-conflict Sri Lanka saw a rally of +250% in the 18 months after the end of the civil war, even without the significant resources to rebuild that Iraq has. Other post-conflict countries' stock markets have also seen tremendous rallies to more than double in the two years after the end of the conflict.

Evidence of the AFC Fund’s post-conflict thesis, since launch, the meaningful capital investment by businesses and individuals brought about by the relative stability of the last five years following the end of the ISIS conflict. While, these years were punctured by several shocks, such as the countrywide demonstrations in late 2019, the assassination of Iran's top general in Baghdad followed by the emergence of COVID-19 and the crash in oil prices in 2020, the undecisive elections in 2021, followed by a year of a political impasse topped by political conflict and violence in the summer of 2022. Nevertheless, these shocks were short-lived and did not lead to self-reinforcing cycles of violence and conflict along the lines of the past. As such, this relative stability provided a more stable and predictable macroeconomic framework for businesses and individuals to operate in and to plan for capital investments on a scale not seen in the last prior decades of conflict; that, in turn, should be sustained by the population's pent-up demand for goods and services to catch up with the rest of the world.

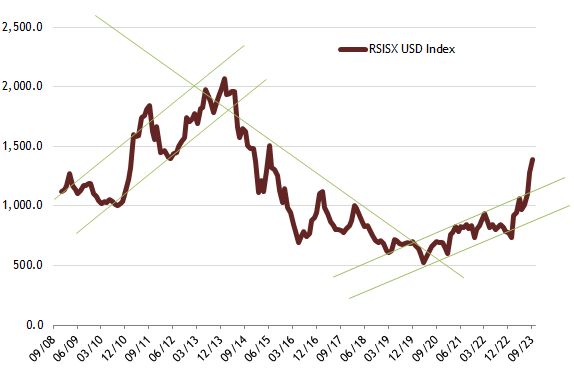

Iraq’s equity market over the last few years discounted all conceivable negatives that dwarf, by orders of magnitude, those that other global markets are in the process of discounting, and so its risk-reward profile is attractive versus global markets. Moreover, it’s in the final stages of emerging from a deep and brutal bear market in which the Rabee Securities US Dollar Equity Index (RSIX USD Index) declined by about 75% from the January 2014 peak to the recent lows of March 2020. Even after the market's strong gains over the past two years, the RSISX USD Index is still down about 33% as of the end of September 2023 from its 2014 peak.

The fund is positioned to continue to capture the opportunities of post-conflict in Iraq and is focused on sectors leveraged to post-conflict recovery, capital spending, GDP growth and consumer spending that are further enhanced by a rapidly growing young population with growing incomes. The fund’s key investments are the key beneficiaries of this wave, including companies in banking, telecom, consumer spending, and energy.

For more information on AFC Iraq Fund please login to review our fund factsheet and investor presentation or be in touch with any questions at This email address is being protected from spambots. You need JavaScript enabled to view it..